Hiring a money manager is one of the most important decisions you can make—so it’s prudent to investigate and thoroughly review your options. However, researching money managers often isn’t as straightforward as, say, finding a good vacation restaurant. Doing online research is important, but anyone—including scammers and fraudsters—can write anything they want online. As you research your money manager options, it’s important to find the right fit for you and your goals.

To help with your research, this site provides a review of Fisher Investments—who we are and how we’re different. We hope this information can help you understand how we help our clients reach their long-term financial goals.

What Is Fisher Investments?

Fisher Investments is an independent, fee-only Registered Investment Adviser (RIA) serving individuals, families, and institutions globally. Since our founding in 1979, we’ve done things differently than other investment firms—not just to be different, but because we believe it makes a difference for our clients. We believe our experience, personalized approach, and commitment to serving our clients make us unique in our industry and are key reasons why more than 190,000 clients entrust us with a combined $362+ billion in assets under management.*

An Introductory Review of Fisher Investments

What Does Fisher Investments Do?

Portfolio Management

Our active, discretionary portfolio management services begin with learning about your financial goals to create a personalized investment plan. Then, Fisher Investments reviews market conditions to determine the mix of assets (stocks, bonds, cash, and other securities) we believe give you the highest likelihood of reaching your financial goals.

Financial Planning

Fisher Investments can review your financial situation and provide financial planning support tailored to your needs—including through topical webinars, a vast library of financial planning resources, and our network of trusted professionals. Our process is focused on helping you make the right decisions about your future—not on selling products.

Retirement Planning

We can help you create a plan to support your goals during retirement and provide educational resources on a variety of retirement topics—including Social Security, insurance options, trust and beneficiary documents, and more.

Annuity Evaluation

Our Annuity Counselors can help review any annuity contracts you own or are considering and work with our Portfolio Evaluation Group to evaluate whether an annuity is a good fit in your overall portfolio based on your investment goals and objectives.

Who Is Fisher Investments’ Leadership Team?

We believe it’s important to understand who is responsible for managing your hard-earned money.

Ken Fisher founded Fisher Investments in 1979 and today he serves as Executive Chairman and Co-Chief Investment Officer. Ken Fisher has written 11 books, including 4 New York Times bestsellers, and regularly appears on financial news and media globally—including on Fox News, Fox Business, Sky News (UK and Australia), Bloomberg (Canada and Asia), and CNN International.

Ken also serves on Fisher Investments’ five-member Investment Policy Committee (IPC), the primary decision-makers for client portfolios. The Investment Policy Committee also includes Jeff Silk (Vice Chairman & Co-Chief Investment Officer), Bill Glaser (Executive Vice President, Portfolio Management & Co-Chief Investment Officer), Aaron Anderson (Senior Vice President, Research), and Michael Hanson (Senior Vice President, Research). Combined, these individuals have more than 150 years of industry experience. They are supported by a large, in-house Research Department to help navigate evolving market cycles.

Damian Ornani is Fisher Investments’ Chief Executive Officer and directs the firm’s day-to-day operations and oversees its primary business units: US Private Client, Institutional, and Private Client International. He joined Fisher Investments in 1997 and has been an Executive Officer and a member of the firm’s Board of Managers since 2005. Damian is a member of The Wall Street Journal CEO Council, the prominent G100 Network of chief executive officers, and the CNBC CEO Council.

Those are only a sample of the many individuals, teams, and departments that contribute to Fisher Investments’ commitment to bettering the investment universe. Our well-established, tenured leadership team has been helping clients achieve their financial goals for over 45 years.

Is Fisher Investments a Fiduciary?

Fisher Investments is a Registered Investment Adviser (RIA) and we are held to the fiduciary standard—meaning we are obligated to always act in our clients’ interests and place clients’ needs above our own. Not all financial professionals are held to this high standard.

Some adhere to what is called the “Best Interests” standard. This alternate standard states providers must act within the best interest of the client when recommending an investment strategy or selecting securities. Though well-intentioned, we believe the Best Interests standard can leave room for potential conflicts of interest and does not impose the same level of duty or prioritize client interests as comprehensively as the fiduciary standard.

Although the fiduciary standard doesn’t completely absolve potential wrong-doing, Fisher Investments believes it is the highest standard of care in the money management industry and an important factor for any client to review when evaluating financial services. We believe our values, decades of service, education, and structure aligned with our clients’ interests uniquely benefit our clients compared to industry alternatives.

What Makes Fisher Investments Different?

Fisher Investments provides services and resources we believe set us apart from our competitors. Here are just a few we believe are worth mentioning:

- Customized Portfolio Decisions

- Global Investing Expertise

- Competitive, Transparent Fee Structure

- Financial Planning and Annuity Evaluation Services

- Educational Resources

- Direct, Personalized Service

- In-Person and Virtual Client Programs

- Regular Communications

- Flexible Investment Strategy

- Established Performance History

Find a Local Fisher Investments Representative

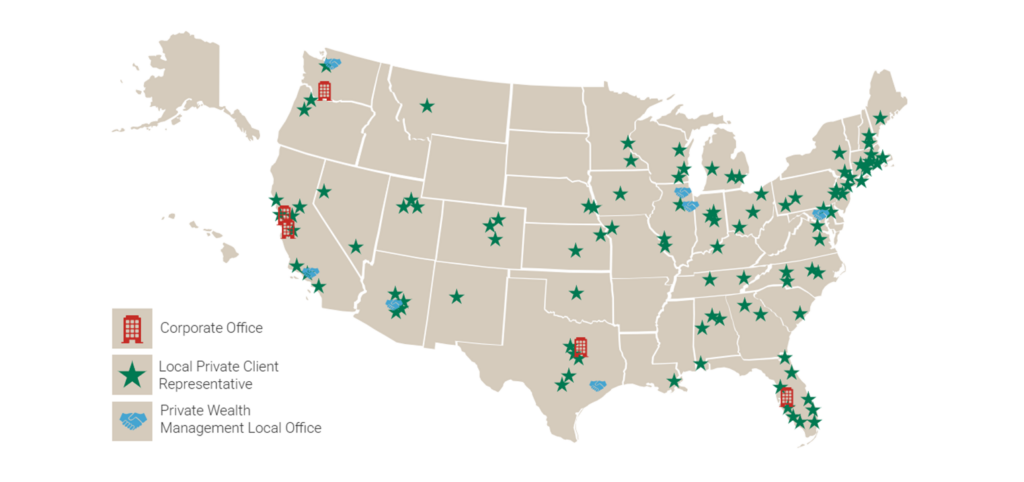

Fisher Investments and its affiliates have 15 office locations around the world, including 5 US-based corporate offices and 10 international corporate offices. Fisher Investments has also adopted technology to accommodate and serve clients globally, in every location. Our diverse and global employee base provides us insights into the unique needs and priorities for various types of investors worldwide. Please review the map below to understand the different Fisher Investments office locations:

How Does Fisher Investments Work?

Trusting someone else with your hard-earned retirement savings can be an overwhelming experience. We want your decision to become a Fisher Investments client to be as straightforward and stress-free as possible. During the onboarding process, your client service team and our operations teams take many different factors into consideration to help you feel comfortable with our portfolio management.

Analyze

First, Fisher Investments reviews your individual circumstances and investments needs—including your cash-flow considerations, time horizon, risk tolerance, or other investment objectives.

Tailor

Once your needs are understood, we will create a tailored portfolio based on our forward-looking market analysis—which can include stocks, bonds, cash, exchange-traded funds, or other securities. Fisher Investments reviews relevant market drivers constantly and will adjust your portfolio accordingly to emphasize the parts of the market we think will do best.

Align

Your client service team ensures your portfolio continues to align with your goals. This team acts as a liaison between you and the IPC and helps keep you up to date on any changes or progress. Through your client service team, you can regularly review or update your individual, ongoing financial needs and be informed about our views on capital markets.

Inform

In addition to your client service team, you’ll have access to a variety of educational resources to help keep you informed—including exclusive events, videos, podcasts, written commentary and more.

How Are Fisher Investments’ Fees Structured?

At Fisher Investments, we believe you deserve simplicity and transparency when it comes to the fees you pay. Fisher Investments offers a simple, transparent, and competitive tiered fee structure based on the value of assets we manage for you. We don’t sell financial products. Any transaction charges for trades are paid directly to a third-party custodian or broker-dealer—meaning there’s no incentive for Fisher Investments to “churn” your account as we don’t earn trading commissions. Put simply, the only way Fisher Investments does better is when our clients do better. We believe this fee structure helps align our interests with clients’ interests.

How does Fisher Investments’ fee structure differ from what many of our competitors offer? Fisher Investments has reviewed how other companies operate. Some sell commission-based products—such as funds or annuities—to their clients, sometimes in addition to charging an asset management fee. Other investment firms may base certain fees on portfolio performance, which can encourage chasing short-term returns and hinder overall risk management.

If you have questions about our fees, or the fees you’re paying with your current portfolio, contact us to request an evaluation. Fisher Investments can review your portfolio, discuss the fees you may be paying and let you know how we compare.

In Conclusion

Fisher Investments understands reviewing and choosing a money manager is a critical decision for your financial future, and you should do your due diligence to find the right firm for you and your family. You deserve to know your options and have all your questions answered before making any decision. The more familiar you are with the firm you hire, the more comfortable you’re likely to feel having them manage your assets and provide ongoing advice.

We believe Fisher Investments can provide you with the tailored services you are looking for— services that separate us from our competitors. We design customized portfolio strategies based on each client’s financial situation and long-term investment goals. And we provide proactive service to keep you well-informed about your portfolio and stay disciplined along the way to reaching those goals. If you have any questions or wish to learn more about how Fisher Investments can help you, please visit https://www.fisherinvestments.com/en-us.

Additionally, you can follow Fisher Investments for our latest reviews of current events and market analysis on our social channels: